Solar Incentives in 2025: Federal & NSW Programs You Can Stack — solar rebates 2025 NSW

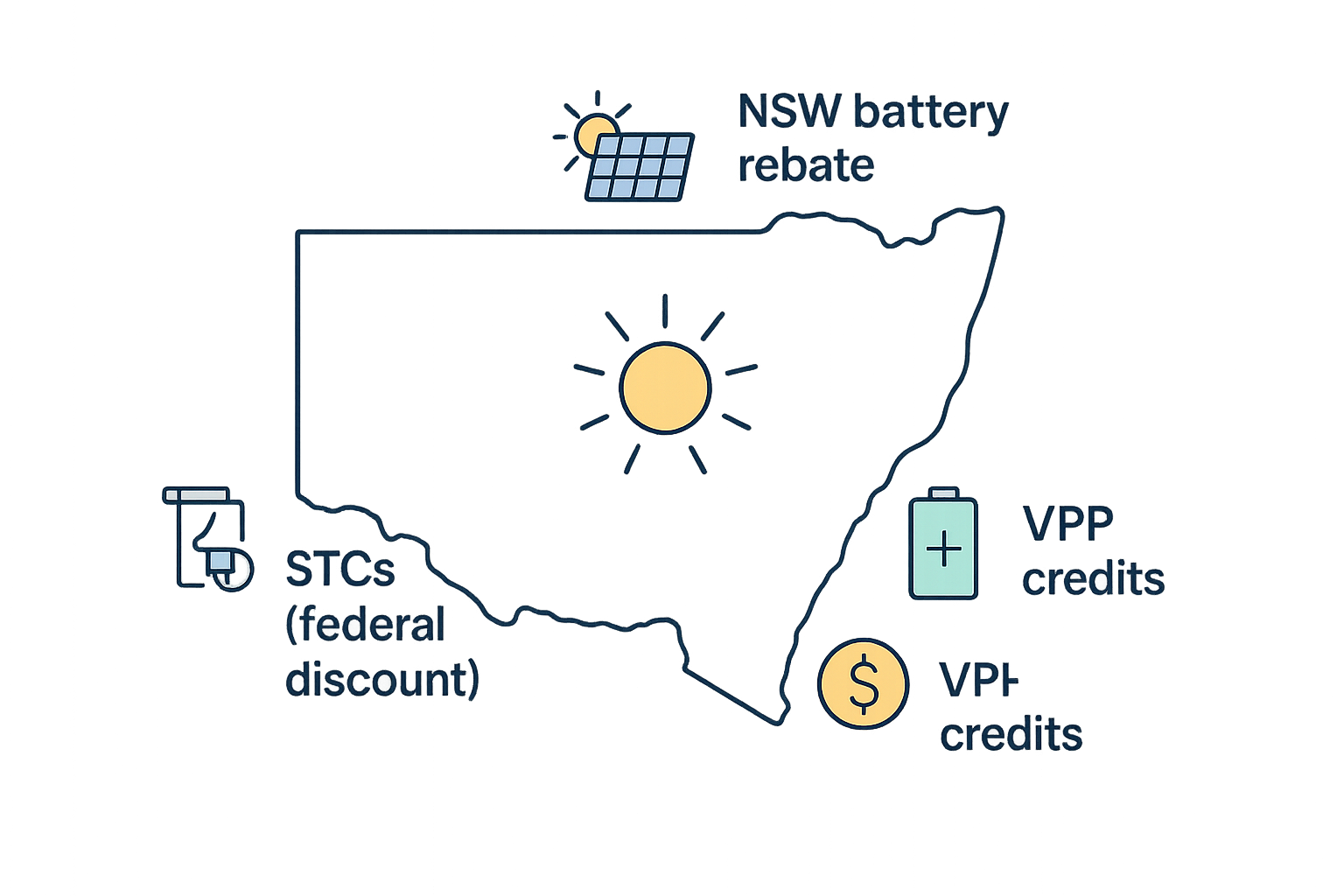

In 2025, NSW households can combine federal and state support to slash solar costs. The federal Small-scale Renewable Energy Scheme (SRES) provides an STC rebate for rooftop solar and batteries[1][2], while NSW offers its own battery rebates, virtual power plant (VPP) credits and council grants. Together, these NSW solar incentives make going solar more affordable. In this friendly guide we explain both federal and state programs, how they fit together, and how you can claim them. (For a quick overview of services, see our [services] page or [Contact Bright Future Energy] for help.)

Federal STCs overview

Australia’s SRES gives each home solar system a number of Small-scale Technology Certificates (STCs) based on its expected generation up to 2030[1][3]. In practice, your accredited installer will register the STCs and pass on the discount to you at point of sale[4]. In other words, the STC value (around 30% of system cost) appears as an upfront rebate when you get a quote. By assigning the STCs to the installer, you don’t need to claim anything later – the saving is built into your invoice[4].

| Element | What it means | Who handles it | When it applies |

| STCs (Small-scale Tech Certificates) | Federal certificates earned per MWh of solar generation or battery storage; drive an upfront rebate.[1][3] | Accredited installer (registrant); Clean Energy Regulator issues certificates | At installation: installer registers STCs when your system is installed. |

| STC Rebate (Discount) | The discount on your solar/battery system price, equal to the STC value assigned. | Installer applies the discount at point of sale; Clean Energy Regulator administers the scheme. | When you sign the contract and install the system; continues under SRES until 2030. |

| Clean Energy Regulator (CER) | Federal agency running the SRES, maintains the REC Registry and enforces compliance.[5] | Government regulator (CER) | Ongoing – regulates STC issuance and audits the scheme continuously. |

| Retailer Obligations (RET) | Retailers must buy (surrender) STCs each year to meet the Renewable Energy Target. | Energy retailers purchase STCs via the market. | Annually – retailers reconcile STCs at the end of each compliance year. |

After installation, any federal solar rebate 2025 or battery rebate from the Australian Government is automatically applied via this STC mechanism[6]. Starting July 1, 2025, the new Cheaper Home Batteries Program will give roughly a 30% discount on eligible batteries (about 9.3 STCs per usable kWh) through the same system[6]. In short, the federal SRES (STCs) reduces your upfront solar/battery bill automatically.

NSW and council programs

On top of federal rebates, NSW offers programs to further cut bills. The Peak Demand Reduction Scheme (PDRS) (formerly Home Battery Scheme) now provides A$1,600–$2,400 off a solar battery, plus an extra A$250–$400 for connecting it to a Virtual Power Plant[7]. From 1 July 2025 the NSW Government doubled its VPP incentive to $1,500 (varying by battery size) so homeowners earn upfront cash for enrolment[8][7]. In practice a typical 11.5 kWh battery can now get ~$5,000 total: about $3,500 federal (30% scheme rebate) plus $1,500 NSW VPP top-up[9].

The NSW Solar & Energy Efficiency Grant program also helps apartment residents and other households. For example, a new Shared Solar PV grant covers up to 50% of the cost of a common-area solar system for apartment buildings[10]. (Owners’ corporations can apply for these grants to save residents on electricity bills.) Local councils often add their own rebates too. For instance, Randwick Council offers 10% off solar or battery installations (up to A$500 for homes)[11]. Check the [NSW Energy Saver rebate finder] or your council website – many councils have sustainability rebates for renewables.

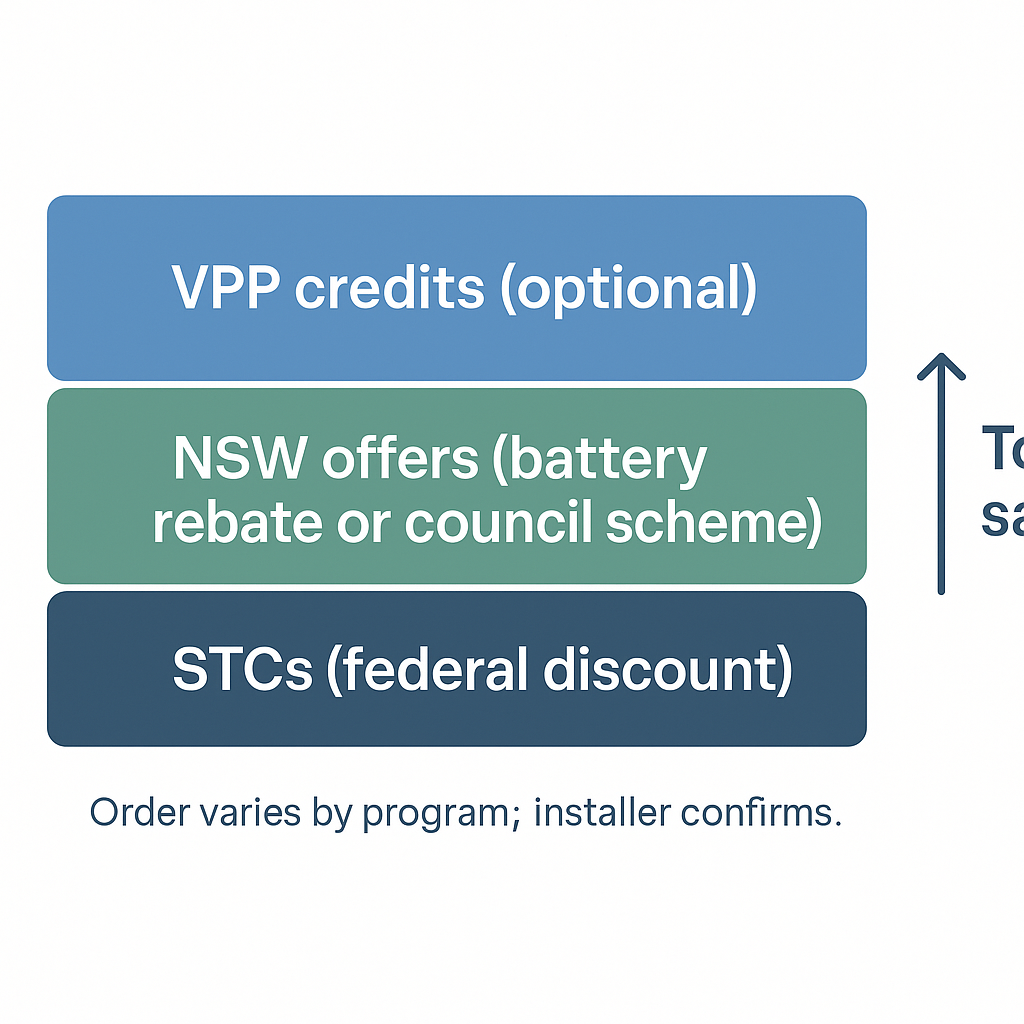

Finally, NSW households still earn ordinary feed-in tariff credits for any extra solar they export (rate varies by retailer). It’s worth checking your electricity plan and asking about any legacy FiT offers. In summary, NSW provides generous stacking opportunities: federal STCs + NSW battery rebate + NSW VPP credit (and council deals if available)[12][11].

How to claim and combine

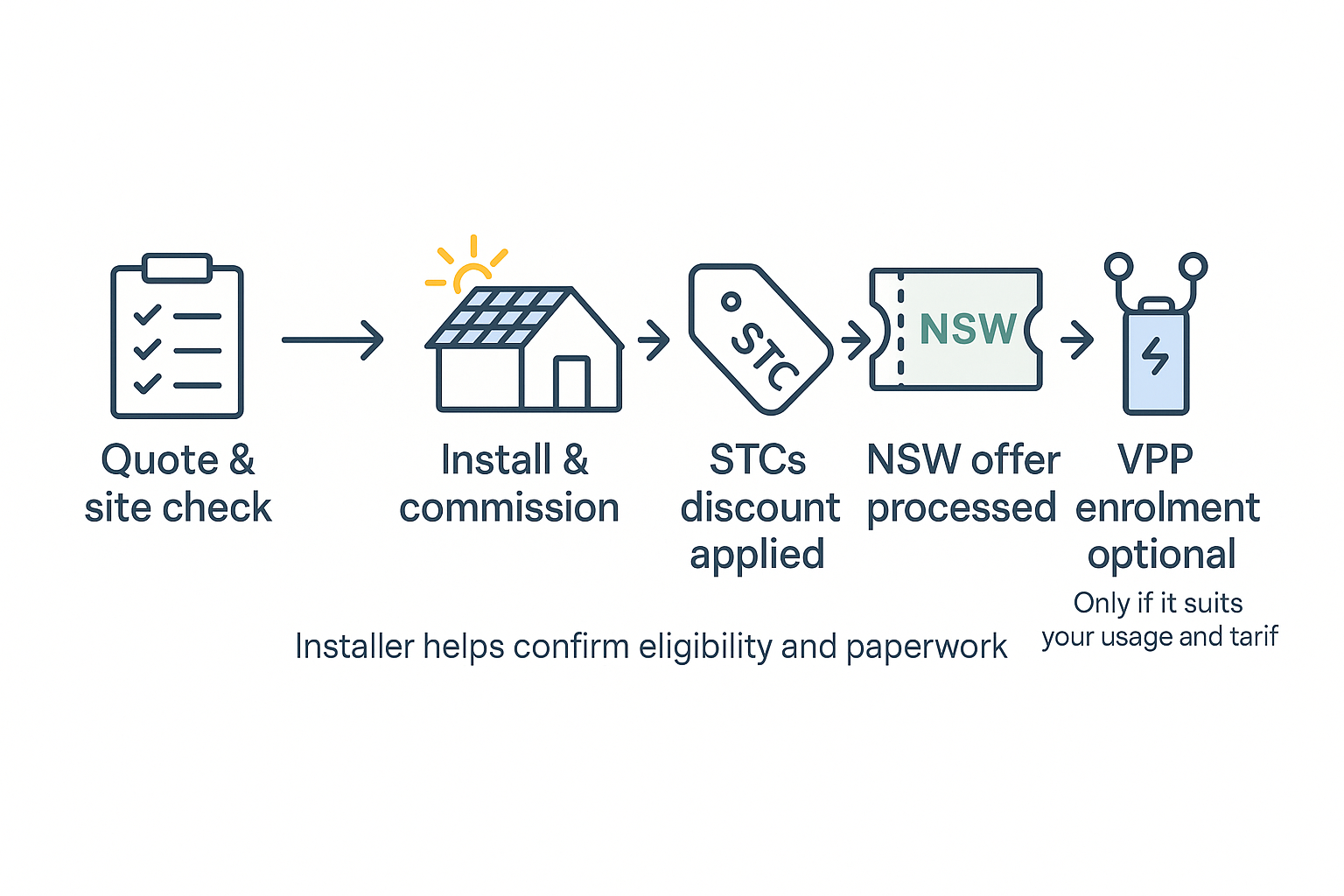

Stacking these incentives is straightforward if you follow the steps. First, get quotes from accredited installers (we recommend at least three). Our [services] page and [STCs explainer] guide note that your installer will handle the STC claim and apply the discount up front[4][13]. Make sure the installer is Clean Energy Council–accredited and on the CER registry – this ensures your system and STCs are valid.

Once you choose a quote and sign the contract, the installer registers the system and assigns the STCs to obtain the federal discount. Next, you can claim any NSW offers: for example, the installer (an Approved Certificate Provider) will apply the state battery rebate/PDRS discount when ordering your battery[7]. You don’t submit separate forms for the battery rebate – it’s included in your installer’s paperwork. Virtual Power Plant credits (the VPP top-up) usually require you to enrol your battery in a VPP program. We recommend contacting [Contact Bright Future Energy] or checking the NSW Energy Saver site for the current VPP application process.

If you have a council rebate, you typically apply directly to the council before or after installation. Keep your invoice and proof of installation handy. For shared solar grants (apartments), your owners’ corporation would apply with NSW Climate Energy Action. In all cases, coordinate with your installer: they often provide guidance or referrals. For instance, to maximise stacking you might mention you want the NSW VPP incentive, so they ensure compatible setup.

Finally, after installation, enrolling in a VPP will let you earn ongoing credits (export payments) as described by AEMO’s DER program[14]. This is the final piece in the stacking path.